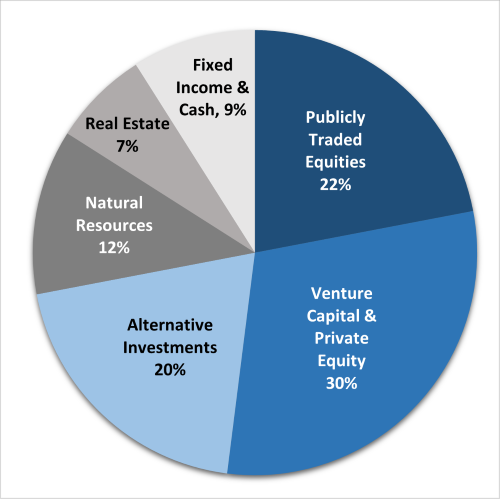

Asset Allocation

The RMC’s asset allocation strategy is to achieve a highly diversified long-term portfolio return while maintaining acceptable levels of risk exposure (risk defined in terms of volatility of returns). This chart illustrates the Board-approved asset allocation targets.

As of September 30, 2024

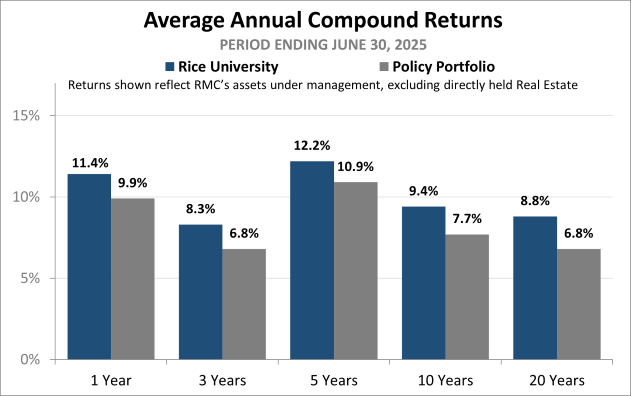

Performance

The endowment return for the fiscal year ended June 30, 2025 was 11.4%. The chart below shows the Rice endowment’s historical performance as compared to benchmarks.

FY25 Returns